Comcast CEO Says “You Can’t Keep Raising The Price Forever,” But Does It Anyway.

He’s not alone.

Federal Reserve officials continue to avoid raising short-term interest rates because inflation remains “stuck at exceptionally low levels,” according to the Wall Street Journal.

Say what?

Inflation: a sustained increase in the general level of prices for goods and services.

The Social Security Administration will to announce that there will be no Cost of Living Adjustment on Thursday, when it releases the Consumer Price Index.

Say what?

The lack of a COLA means that older people will face higher health care costs. Younger people already are.

The Unaffordable Care Act was passed based on per capita health care costs of $7,825 under the Bush Administration. Obamacare promised to save us money. So far, per capita health care has cost $8,054 in $2009, $8,299 in 2010, $8,553 in 2011, $8,845 in 2012, $9,146 in 2013, and it is expected to come in at $9,458 in 2014 and $9,800 in 2015, all under the Obama Administration.

“Oddly, I’ve been spending more and getting less for everything but driving around,” my roofer friend Dean “Dino” Russell told me. “Milk for my cats is up to $4.79 a gallon. I don’t even buy beef anymore.” Hamburger sold for about $2.19 per pound at his Publix in 2008; it was “on sale” for $4.79 this week. And gas may be cheaper than a year ago but it hasn’t come back down to the kind of prices we had for more than a decade.

Dino won’t even talk about how much his health insurance or windstorm insurance costs.

I ran the numbers for Dino’s neighbor, Ralph. Ralph is 38, single, lives in Miami, and earned $46,494 last year, so that’s the basis for his Obamacare premium. He paid $370.40 per month ($4,444.80 total this year). His insurance company received a 16% increase for 2016.

Speaking of price hikes…

• I have the misfortune of contracting with “Citizens” Property Insurance Co. I don’t know how they came up with the name with a straight face. “Citizens” was established by the Florida Legislature as a not-for-profit insurer of last resort. It quickly became the largest insurer in the state and about the only place we can get windstorm insurance.

• I have the misfortune of contracting with “Citizens” Property Insurance Co. I don’t know how they came up with the name with a straight face. “Citizens” was established by the Florida Legislature as a not-for-profit insurer of last resort. It quickly became the largest insurer in the state and about the only place we can get windstorm insurance.

I paid !@#$%^Citizens $2,455 for wind storm coverage in 2008. The price has risen more than health care every year. I paid !@#$%^Citizens $4,489 for wind storm coverage in 2015.

“It’s the higher water damage claims in the Keys”, a Citizens rep said. “Otherwise we would have reduced property insurance rates for most homeowners here.”

OK. Wait. !@#$%^Citizens insures against wind storm damage. They refuse to pay for water damage, referring those to FEMA or your homeowner’s policy. And the last major hurricane to hit South Florida was Wilma in 2005. In fact, Fitch upgraded their bonds to “AA-” thanks to !@#$%^Citizens’ successful efforts to reduce its exposure to claims by lowering and transferring risk not to mention the small fact that there have been no hurricane losses over the past nine years.

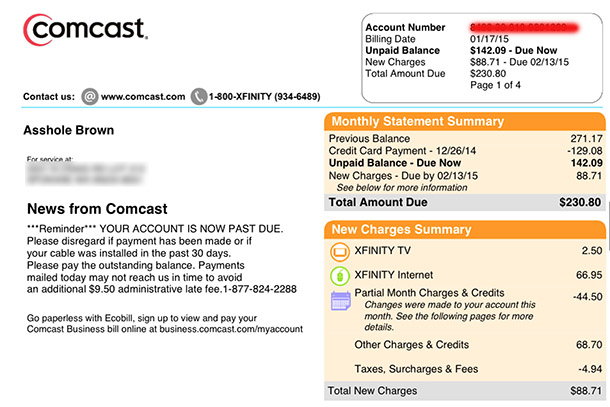

• I paid !@#$%^Comcast $742.59 for basic cable and Interwebs in 2008.

• I paid !@#$%^Comcast $742.59 for basic cable and Interwebs in 2008.

“Our rate hasn’t changed,” a !@#$%^Comcast rep told me.

OK. Oh, wait. I paid !@#$%^Comcast $1,169.10 for basic cable and Interwebs in 2015. I guess a 57% increase isn’t actually a rate change. The Baud rate has mostly stayed the same though.

• Elsewhere, Verizon says it will raise the price of its remaining unlimited data plans by $20. Again.

• Elsewhere, Verizon says it will raise the price of its remaining unlimited data plans by $20. Again.

“Verizon will not increase the price on any lines with an unlimited data plan that is currently in a two-year contract,” the company said.

“When this happens, I will probably leave Verizon,” Liz Arden said.

Verizon has been wallowing in extra money from all the customers who own their own phones but pay full subsidized phone prices for service. “The only people left on unlimited plans are people like me [who own their own phones] so VZW’s been pocketing all that extra cash,” she notes.

We can leave !@#$%^Verizon. We’re stuck with !@#$%^Citizens. We’re stuck with !@#$%^Comcast.

Can you hear me now?

It turns out most companies raise prices for only two reasons: when they can do it without alienating their customers and when they don’t care about alienating their customers.

Verizon and Comcast and Citizens don’t care if they alienate customers. In fact, Citizens wants to drive customers away but it, like Comcast, is the only game in town.

Despite consistently ranking among the bottom ten companies in the world, Citizens, Comcast, and Verizon are breaking the banks financially. Citizens is a “non-profit.” They can levy 10% emergency assessments on nearly every policy holder in the state forever and in an unlimited amount to pay off bonds. Comcast reported $8.38 billion net income on $68.78 billion sales. Verizon reported $4.22 billion net income on $127.08 billion sales.

Wouldn’t it be loverly if we thought not doing business with these laughing stocks would change their behavior?

“It would work better to punish them,” Ms. Arden said.

Oh, and by the way? Gas prices will rise in January.