Today is America’s primary pagan festival, celebrated to show love to the gods for a bountiful harvest on a New England day in which fields are now mostly covered in snow and which George Washington proclaimed as a day of thanks as a national remembrance.

Whereas it is the duty of all Nations to acknowledge the providence of Almighty God, to obey his will, to be grateful for His benefits, and humbly to implore His protection and favor, and Whereas both Houses of Congress have by their joint Committee requested me ‘to recommend to the People of the United States a day of public thanksgiving and prayer to be observed by acknowledging with grateful hearts the many signal favors of Almighty God, especially by affording them an opportunity peaceably to establish a form of government for their safety and happiness’.”

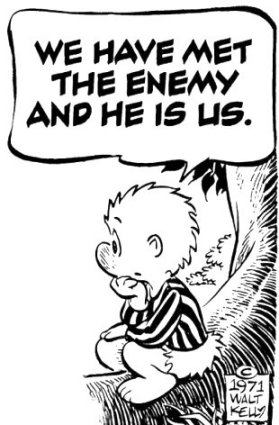

While it is easy for this curmudgeonly writer to kvetch about the corruption and thievery stretching from here to Washington or to fret that my truck needs new brake lines and my little house needs new shingles, those are just everyday irritants and (thankfully) I know how to fix them.

I am thankful I have a white truck. Not to mention a (topless)(white) car. And that Anne has white car.

I am thankful my grandfather at age 94 decided to live out his very good life in the Keys.

I am thankful I started my life as an engineer and am now spending some of it as an artist.

I am thankful we will have friends here today.

I am thankful my children, my grandchildren, and my great-grandchildren are happy, healthy, and will be well fed again today.

I am thankful Anne is here today and will be here tomorrow.

I am thankful for Anne and for Nancy, two loving, caring, beautiful ladies. I am blessed.

And I have pah!

Ben Franklin thought the turkey should be America’s bird so I’m thankful to have found a big inflatable turkey in a local yard. The original Thanksgiving Perspective is here.

As an aside, it’s mostly our (local) money. Because Monroe is considered “property-rich,” 90% of school funding is raised through local property taxes, with the remaining 10% coming from the state. That means of the $1.4 million earmarked for the raises, the state kicked in about twenty-seven cents.

As an aside, it’s mostly our (local) money. Because Monroe is considered “property-rich,” 90% of school funding is raised through local property taxes, with the remaining 10% coming from the state. That means of the $1.4 million earmarked for the raises, the state kicked in about twenty-seven cents.