We the Overtaxed People dread most April fifteenths but that terrible day has been delayed to April 18 again this year.

“Tomorrow, tomorrow, I love ya tomorrow

You’re always a day away …”

Emancipation Day, a little-known holiday beyond the Beltway, is the primary reason the tax deadline changed this year. Slavery was formally abolished in the United States December 6, 1865, when the 13th Amendment was ratified, but it occurred much earlier in the District of Columbia: President Abraham Lincoln signed the Compensated Emancipation Act on April 16, 1862, freeing the thousands of slaves who lived in the district. Now a legal holiday in Washington, government offices and other public services do not operate on Emancipation Day, usually celebrated April 16. Emancipation Day falls back to April 15 or ahead to April 17 when it falls on a weekend because we couldn’t deprive civil servants in that city of a holiday.

Emancipation Day, a little-known holiday beyond the Beltway, is the primary reason the tax deadline changed this year. Slavery was formally abolished in the United States December 6, 1865, when the 13th Amendment was ratified, but it occurred much earlier in the District of Columbia: President Abraham Lincoln signed the Compensated Emancipation Act on April 16, 1862, freeing the thousands of slaves who lived in the district. Now a legal holiday in Washington, government offices and other public services do not operate on Emancipation Day, usually celebrated April 16. Emancipation Day falls back to April 15 or ahead to April 17 when it falls on a weekend because we couldn’t deprive civil servants in that city of a holiday.

This is the second year in a row.

In other tax news, tax-refund fraud continues to soar this tax season. It will top $21 billion this year, up from “just” $6.5 billion three years ago, according to the Internal Revenue Service. The IRS’ own “Dirty Dozen” lists the common scams that peak during filing season as people prepare their returns or hire someone to help with their taxes. Half are crimes against us including phishing, phone scams, and identity theft.

Elian Matlovsky of Staten Island was found guilty in what the prosecutor described as “one of the nation’s largest and longest running stolen identity tax refund fraud schemes.”

Here’s how it worked. Ms. Matlovsky and the other defendants were found to have filed more than 8,000 fraudulent federal income tax returns for more than $65 million in tax refunds. They did it by stealing Social Security numbers and dates of birth and using that information to file the false returns claiming refunds.

My liberal friends like to make hay on the fact that the rich don’t pay taxes but my liberal friends are wrong.

I ran a quick guestimate for the fabled “one percenter” with a gross annual income of $1,260,508, a $10,000 retirement plan contribution, $26,690 in itemized deductions, and two kids. That taxpayer has $1,152,975 in taxable income and will pay about $411,339 in taxes. The effective tax rate is 32.6% and the marginal tax rate is 39.6%. (That gross annual income is the least that qualifies for “one percent” status.)

Now look at a “ten percenter,” a married engineer earning $133,445 in salary with no investment income, a $5,000 retirement plan contribution, $13,345 in itemized deductions, and two kids. That taxpayer has $107,000 in taxable income and will pay about $17,465 in taxes tomorrow. The effective tax rate is 13.1% and the marginal tax rate is 25.0%. (That gross annual income is the least that qualifies for “ten percent” status.)

“The tax code is about 2-1/2 times the length of Stephen King’s It–except you replace ‘scary clown’ with ‘accounting methods’.”

Finally, consider the married person who earned $40,190 in wages with no other income, no retirement plan contribution, taking the standard deduction, and two kids. That taxpayer has $19,490 in taxable income and will pay about $0 in taxes tomorrow. The effective tax rate is 0.0% although the marginal tax rate is still 15.0%. (That gross annual income is about the most a family of four can make before paying $12 in income tax for the year.)

Want to tell me again who pays the least taxes?

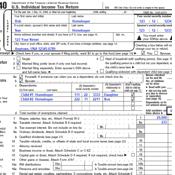

There are now more than a thousand pages of tax forms.

Slate, apologizing again for Big Government, would have us believe the tax code wasn’t 70,000 pages long in 2013. It was “only” 4,037 pages then. Oh, goody.

Want to tell me again why this is fair.

Just remember, the very same people who want nationalized, government-run, single-payer health care (“Medicare for All”) oppose the simple, fair flat tax. I’m pretty sure there is a moral in there somewhere.

your bottom dollar will be gone!