“Too often in recent history liberal governments have been wrecked on rocks of loose fiscal policy.”

Here’s a revolutionary idea.

Independence Day commemorates our declaration of independence from the King of England. The revolution officially began two days earlier when the Second Continental Congress approved the legal separation of the American colonies from Great Britain, a resolution proposed by Richard Henry Lee of Virginia in June. After voting for independence on July 2, Congress debated and revised the Declaration itself for two whole days and approved it on July 4.

Independence Day commemorates our declaration of independence from the King of England. The revolution officially began two days earlier when the Second Continental Congress approved the legal separation of the American colonies from Great Britain, a resolution proposed by Richard Henry Lee of Virginia in June. After voting for independence on July 2, Congress debated and revised the Declaration itself for two whole days and approved it on July 4.

In the centuries since, only the 111th Congress has moved with anywhere near the speed of that first gathering, since the 111th Congress passed trillions of dollars of spending on millions of pages of bills in less than 100 days. And no one in Washington read any of them.

The Declaration of Independence fits on one page. Everyone in the Continental Congress read the whole thing. Imagine that.

In Peoria just one hundred fifty-seven years ago, the young Rep. Abraham Lincoln said,

Nearly eighty years ago we began by declaring that all men are created equal; but now from that beginning

we have run down to the other declaration, that for some men to enslave others is a “sacred right of self-government.” … Our republican robe is soiled and trailed in the dust. Let us repurify it. … Let us re-adopt the Declaration of Independence, and with it, the practices, and policy, which harmonize with it.

Lincoln spoke of the enslavement of persons. Today our republican robe is soiled and trailed in the dust by a government that would enslave We the Overtaxed People, taking more and more of our rights and our land and our life’s blood to its own purpose.

Just to rekindle our liberal friends, Franklin Delano Roosevelt made the “loose fiscal policy” quote.

The second session of the current 115th Congress is back to its usual wiener roasts (they have “worked” 81 days this year and are off for the months of July and August) and Nero Claudius Caesar Augustus Germanicus is indeed still fiddling in Washington.

Two hundred thirty-six years ago tomorrow, General George Washington marked July 4 with a double ration of rum and an artillery salute for the soldiers who fought off the foreign monarchy that did enslave us. It is now time to mark July 4 with a double ration of electoral salute to those who would be the modern monarchy of government.

The tree of liberty must be refreshed from time to time with the blood of patriots and tyrants.

Let us re-adopt the Declaration of Independence, and with it, the practices, and policy, which harmonize with it. Can you do that? Take the test if you dare.

Much of our litigious life today grew out of English Common Law. We abandoned one really good idea in the first Revolution, though. We abandoned the No Confidence vote.

An earlier version of this column first appeared in 2011.

I guess he doesn’t remember “we have to pass the bill so that you can find out what’s in it…”

I guess he doesn’t remember “we have to pass the bill so that you can find out what’s in it…”

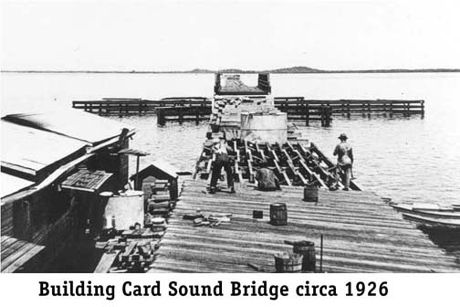

The toll booth staff will be fired July 31 and the toll booths could be demolished the next day. No tolls will be collected during reconstruction, until the system becomes active next February. The “All Electronic Tolling System” will connect to the Sunpass to collect tolls through those transponders or toll-by-plate.

The toll booth staff will be fired July 31 and the toll booths could be demolished the next day. No tolls will be collected during reconstruction, until the system becomes active next February. The “All Electronic Tolling System” will connect to the Sunpass to collect tolls through those transponders or toll-by-plate.