Two more not so affordable parts of the Unaffordable Health Care Act:

1. You don’t qualify for a subsidy if your income is less than 100% of the Federal Poverty Level.

2. Likewise you don’t get a subsidy if your filing status is “married filing separately.” If you’re married, your tax filing status must be “married filing jointly” in order to qualify for a subsidy.

“So, the poor folk this is designed to cover can’t afford it?”

$11,490. That’s the 2013 Federal Poverty Guideline for one individual living anywhere in the 48 Contiguous States and the District of Columbia.

$11,491. That’s the minimum one individual living anywhere in the 48 Contiguous States and the District of Columbia can earn to qualify for an Obamacare subsidy

25,273,000. That’s the number of individuals living anywhere in the 48 Contiguous States and the District of Columbia who earn less than $11,490.

25,273,000. That’s the number of individuals living anywhere in the 48 Contiguous States and the District of Columbia who don’t qualify for Obamacare premium tax credits or cost-sharing subsidies.

That’s right, Pookie, if you are the poorest of the poor, you don’t get premium tax credits or cost-sharing subsidies. [Note to those who are counting, some but not all of those 25,273,000 do qualify for Medicaid.]

“And if you and your spouse don’t live together, you’re basically screwed.”

About 2,408,000 people filed separate returns in 2009, the most recent year the IRS has published. About 1,811,779 (One million, eight hundred eleven thousand, seven hundred seventy-nine) of those reported less that $49,960 in income, the cut-off for individual subsidies. One point eight million people left out by the Unaffordable Care Act.

Well, Pookie, you might not be getting screwed but, yeah, you are.

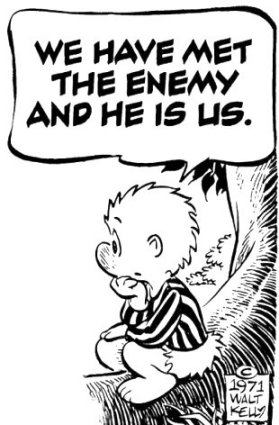

If you support Obamacare, this is what your crutch hath wrought.