Like millions of Americans (except Rufus), I used tax preparation software again this year. Rufus is about the only individual filer I know who uses a computer and who does his taxes in a spreadsheet.

Like millions of Americans (except Rufus), I wanted to “click here” and have a finished return print out with the stamp(s) already attached.

Sigh.

I don’t much like Intuit’s Tubbo Tax. I’ve had years of experience trying to get that program to manage my not-very-complicated mix of a couple of small businesses and some 1099s from Charles Schwab, a brokerage house of which neither Intuit nor H&R Block has heard. I decided to try the other guys this year.

Yup, I bought into H&R Block At Home. Deluxe.

Mr. Block will be history here in No Puffin in 2011.

My first run through, it gave me twice the mortgage interest deduction I had entered. I’m sure I made a mistake by putting it in twice, but I have no idea where. I burned down that return and started over using the tax-software-for-dummies interview exclusively.

My first run through, it gave me twice the mortgage interest deduction I had entered. I’m sure I made a mistake by putting it in twice, but I have no idea where. I burned down that return and started over using the tax-software-for-dummies interview exclusively.

“That is the problem with these freakin’ programs,” Rufus said. “They presume you have no idea what you are doing (or that you know the software intimately.)”

When I assumed I knew what I was doing, Mr. Block said I would owe a few grand more in taxes than I had already paid in. That was also when I saw Mr. Block had doubled the declarable mortgage interest I claimed.

Time passes.

The time came to checkprint the Vermont return (“full return for filing” the Blockheads call it). Mr. Block did not print the three Vermont homestead claim forms. Vermont has those forms online as PDFs, fortunately, because nobody mails tax booklets any more. Unfortunately, all I can do is print them and fill them out by hand.

Transferring all the appropriate figures from one form to the next (which is why we all buy tax software) and doing the calculations (which is why we all buy tax software) is all on me.

By hand.

!@#$%^ Blockheads.

I don’t care how much trouble Tubbo gave me, at least it printed all the freaking forms I need.

The very nice overseas tech support girl said, “First I want you to reinstall Windows…”

Actually, she sent me a link to download a new copy of the program. Yes, they wanted me to uninstall my current copy of H&R Block At Home and install the new copy. As expected, the new copy of the program comes with exactly the same state feature as the purchased CD has, meaning that after I install it, I must then download the Vermont files from exactly the same place I got them last time.

!@#$%^ Blockheads.

So I uninstalled the old version and installed the new one. The uninstall apparently did not remove the registry entries because it knew just where I had left all the data files.

Time passes.

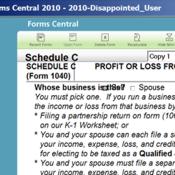

Mr. Block includes an Error Check. It found a bunch, many related to Copy 9 of the Vehicle Worksheet for which the program couldn’t figure out in which Schedule C it belonged. Their Forms Central display is so crammed together that I simply can’t tell what data it has, let alone where it belongs.

Mr. Block includes an Error Check. It found a bunch, many related to Copy 9 of the Vehicle Worksheet for which the program couldn’t figure out in which Schedule C it belonged. Their Forms Central display is so crammed together that I simply can’t tell what data it has, let alone where it belongs.

Time to checkprint the Vermont return. Again. Everything is still smushed together.

Mr. Block has a nice online forum with bonafide tax experts just moments away to answer your pressing tax questions in real time. I posted as “Disappointed User” yesterday evening.

“Q: This program won’t print anything but squeezed together ‘Not For Filing’ pages.”

Mr. Block answered my question this morning at 4:39 ayem through Kathleen Drenzek, Master Tax Advisor and Enrolled Agent who wrote: “Disappointed, did you try rebooting your computer to see it that works. Or call tech support at 1-800-HRBLOCK.”

Another happy user worried about this:

“Q: software is telling me I sent my tax estimate late and owe a fee- but in RI we got an extension last year. What to do?”

Jayant Kanitkar, Master Tax Advisor and Enrolled Agent wrote: “If you believe otherwise, pay only the amount due.” What, is he nuts?

I think I did resolve the smushy question. When it prints its “mini worksheets,” it sends out the smushed up text you see in the example. When it print the return forms alone, they appear to come out fine.

OK, sort of fine. It is still printing three blank copies of Form 4562-page 1, but I can simply throw those away. And it keeps putting xxxxxxxxxxxxx in for the bank account number. Means no e-filing for me, though.

Looks like I cannot use even the one form TaxCut DID print. Here’s the word from the Vermont Tax Department:

FORMS THAT CANNOT BE PROCESSED

If your filing is not acceptable for our processing equipment, the Department may send your filing back to you… The Department may also transfer your filing information onto acceptable forms but you can be assessed a $25 processing fee that partially covers the costs of transferring the information. Examples of unacceptable filings are: forms marked “draft”, forms not pre-approved by the Department, photocopies of forms, faxed forms, writing in other than blue or black ink, and mixing computer generated forms with forms printed by the Department.

This software used to be called TaxCut but H&R Block wanted to leverage their own name to boost sales.

Why?

If this were my program, I’d never put my name on it. I might call it Rufus’ TaxCut. Anything but Dick’s Own Software.

Despite all that, I made the trip to the post office today. All three returns are in the mail at a cost of only three Forever stamps and two additional ounces at the new-today rate.

I wonder if the IRS shares DNA samples collected today with other agencies.

Dear H&R Block

Why did you not include Vermont’s REQUIRED HI-144, HS-131, or HS-145? Why do I have to do those by HAND?

signed, Disappointed User

Sr. Tax Advisor Phyllis Askew answered me

Sorry, Phyllis Askew, but that was a poor answer. Many state forms may not be available until the middle of February but this is the middle of April. One day before taxes are due. The program, purchased on CD, included no printed information about updating the state information. I DID (try to) update the program but both federal and state update centers say “No updates are planned.”

signed, Disappointed User

Well. You certainly give good rant!

Yes, Gekko, he does rant well. And understandably so. I do not rant, I whine — and understandably so, too.

Last February I purchased Turbo Tax Delux for $39.99 and finally got around to doing my taxes on April Fool’s Day. The software would not work and gave me an error message that it could not *fix* something called Microsoft. NET 3.5 SPI which was allegedly included with the Turbo Tax CD.

I, being the geek I am, assumed I had a bad CD, so I rushed down to Sam’s and bought another $39.99 CD. The new CD would not work either; so I deduce that the problem is on my end — prolly an operating system not powerful enough to handle Intuit’s new Turbo. Woe was me.

I trekked to the IRS office building, faced off against some surly armed guards and found the blank forms and instruction books I needed to do the taxes myself.

I ended up writing a check to the Treasury Department much larger than I had hoped. If I overpay them, surely they will catch the error and return it to me.

— George

George says:

“If I overpay them, surely they will catch the error and return it to me.”

No doubt, George. None.

I simplified a lot this year. I just filed the Form 4868 (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return,) which is stone simple. I estimated my tax liability at $0.00.

This, of course, required me to also file the Form 4868-X (You Clowns Are Actually Buying That Estimate Of U.S. Individual Income Tax Liability?) but that one is also just a couple of lines.

Done and done! I don’t understand what the problem is.