April 15. Wednesday. Midnight. 60.0 hours from right now.

7% of people receiving a tax refund will “fritter the money away” on a shopping spree or vacation according to a new Bankrate.com poll.

“Cuz pleasure is bad. It’s so … frittery,” Liz Arden said.

Exactly. Our Victorian more, except most (well-to-do) Victorians seemed to want more.

A new-to-me camera is not frittering.

Rufus just bought a Fishman Aura Spectrum DI which has cool samples of jumbos, dreadnaughts, OMs, 12 string guitars and more to blend with the output of his guitar.

“I’m very excited to get this (used, of course, about 1/2 the price of new),” he said. “It’s an everyday necessity.”

I agree, but neither of us exactly needs more stuff.

The real news is that only 7% of “recession weary Americans” are frittering. A whopping 84% of Americans receiving refunds intend to pay down debt, save or invest their “windfall,” or use it for everyday necessities, according to that poll.

“Taxes ought not be so difficult or expensive to figure out and pay.”

SWMBO and I don’t make a lot of money. In fact, now that we are on what is laughably called a “fixed income,” we really don’t make a lot of money. Still, we live in different states from each other and have a couple of separate very small businesses so Uncle Sam and the great state of Vermont have trained me to dread April.

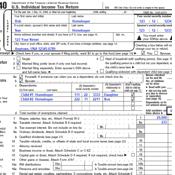

I do my own taxes.

I used to be able to do it with a calculator and some scratch paper.

After a while, it just got easier to do them with a spreadsheet on the computer.

After a while, all the rules changes made it too tough to do with a spreadsheet on the computer so we switched to Tax software. I’ve experimented with most of the major programs and settled on TubboTax™ as the least bad of the bunch.

Here’s this year’s tale of woe:

February 20:

I loaded and started work in Tubbo. Irritating program; I tried opening the files from prior years with it so I could fart around with some Vermont demands but no joy.

Then I started in on this year’s. No joy there, either. For example, I bought a new, under-$200 printer that has to be depreciated. Tubbo wouldn’t let me close the asset entry worksheet because I apparently made a mistake in my SDA elections. I don’t even know what a “Special Depreciation Allowance” is, let alone why I have to elect it on a sub-$200 piece of office equipment. All I know is that I checked exactly the same boxes on the printer this one replaced.

The help was of little, well, help.

Time passed. I entered stuff.

I’m a Florida resident. I have no remaining connection to Vermont except a spouse who is a Vermont resident. I live here. She lives there. We file “Married-Separate” because we have separate households.

Vermont sent her a letter demanding my returns for the last three years. I’m a Florida resident. I have no Vermont income. None. Vermont says we need to file “Married-Joint” because we’re not, well, separated.

March 7:

“I haven’t started my taxes yet,” Rufus said.

I started the joint return with Anne as the primary filer, then did a dope slap because I live in Florida.

I started the joint return with Anne as the primary filer, then did a dope slap because I live in Florida.

Converted the self/spouse thing. I think. Tubbo has no way to switch the primary filer on a joint return. I don’t know why Tubbo has no way to switch filers. It’s a database. It’s a check mark. It should be trivial. Tubbo has no way to switch filers.

I thought I had gotten Tubbo to recognize everything. That turned out to be not quite correct.

My friend Fanny Guay bought an ObamaCare policy. She filled out the HealthCare.gov questionnaire which asked for last year’s income and got a $529 monthly “discount” that brought her premium down to $34/month. Cool, huh?

She had no idea that the “discount” was in reality a Monthly Advance Payment of the Premium Tax Credit.

She filled out her 1040 online and was blown away when the IRS wanted $3,800 of that Advance Payment of the Premium Tax Credit back. See, last year Ms. Guay and her older hubby hadn’t taken a large IRA distribution. This year, they did. Her income changed and that changed the premium.

Ms. Guay got screwed.

March 23:

“I haven’t started mine yet,” Rufus said.

SWMBO’s Vermont return uses a “recomputed” 1040. Tubbo shows me as not over 65 as of 12/31/14 (I was). It included a Federal Schedule K-1 (neither of us got one). It gave us a $2,485 self-employed health insurance deduction (that doesn’t appear on any other Form 1040). And it created a Vermont Credit for tax paid to another state. Alabama. (We really really don’t even drive through Alabama.)

April 4:

“I haven’t started mine yet,” Rufus said.

I spent the day on picayunia. I still don’t know how to fix Tubbo’s belief that I’m not 65. I overrode their selection. And, since I paid a few bucks as a 15% foreign tax to Canada, I reckon I should file Form 1165 to maybe get a credit for it. Nupe. Not according to Tubbo.

I sent SWMBO a review copy of her Vermont return using a 70 cent Great Spangled Fritillary.

April 5:

“I should start my taxes,” Rufus said.

I spent even more time convincing Tubbo to use the same numbers in the recomputed copy as the Joint copy of same exact tax file.

April 11:

“I, um, haven’t started mine yet,” Rufus said.

E-filing was as screwed up as the rest of Tubbo. I started with [Click here to e-file] that evening and didn’t finish until 12:10 a.m.

At the end of the process, Intuit asked if I’d like to rate my experience.

[OH BOY!OH BOY!OH BOY!]

The link took me to intuit.com and the page never loaded. It said LOADING… but that was it. No progress meter. Nothing on the progress bar. No new page showing. Nothing. LOADING…

In between, they decided to send my refund to some broker instead of the bank, thought SWMBO’s PIN was mine and vice versa, and reversed our addresses. Maybe. Or they think “Swmbo K Harper” is “Dick” and “Richard B Harper” is “Swmbo.”

And, natch, IRS rejected the return.

F1040-526-02 – If you’re Married Filing Jointly and you’ve entered an e-filing PIN, you must enter your spouse’s date of birth or, if deceased, your spouse’s date of death.

F1040-525-02 – The Primary Taxpayer Date of Birth or Date of Death is missing. Please review your return and make the necessary corrections.

Both our dates of birth are plainly in the return, right there on the Info Worksheet.

I finally figured out that Tubbo does not store the nicknames in any accessible form. They go in about six steps down during the step-by-step “interview.” I had to run the interview again to change that. It seems to have fixed the birth date glitch.

One might expect something as important as a birth date to be tied to the same field as the Social Security number.

The Tubbo help system had no knowledge of how to change a nickname. The Tubbo help system had no knowledge of how to swap primary filer. The Tubbo help system had no help.

!@#$%^Tubbo. The !@#$%^Comcast of tax returns.

It would have been easier to print and mail. A lot easier. SWMBO mailed hers today.

!@#$%^Tubbo.

Anyway, I found the nickname source on my own, corrected that and a couple of otter glitches, and refiled. Success to the extent that the IRS accepted the return. I wish I had some idea of what is in the data stream.

What’s the bottom line?

“I, um, haven’t started mine yet,” Rufus said.

A flat tax would solve this. We’d never need !@#$%^Tubbo again.

In 1980, I spent about 16 hours putting together a 9-page tax return. In 2015, I spent about 80 hours putting together an 18-page tax return. And I have no idea of what is in the data stream @#$%^Tubbo sent to the IRS.

60 hours to go. Have you started yet?

April 24 is Tax Freedom Day this year, a day later than 2014 and four days later than 2013.

Yeppers, the economy is booming.

And, ahead of Tax Day, the Wall Street Journal‘s Laura Saunders discusses how tax burdens broke down in 2014. Here’s a hint. People who make a lot of money pay the lion’s share, just as we’ve pointed out all along. Here’s another hint. Congress wants everyone, even thee and me, to pay more. Lots more.

“There is little chance of tax overhaul this year.”

Started yesterday